Table of Contents

- Iger Told to Sell Disney Park Assets Due to Major Stock Price Dips ...

- Disney Stock Squeaks and Drops After Closing Billion Fox Deal

- Is the Disney Stock Sell-Off a Prime Buying Opportunity? | StarTribune ...

- Disney stock - AymiRavjot

- Florida Won’t Sink Disney Stock — But a Bigger Problem Looms

- Disney (DIS) Stock Forecast: Can It Beat Netflix in Streaming by 2025?

- Disney Stock Down Nearly 9% Since Yesterday’s Closing - Disney by Mark

- Disney Stock Price Target 2025 - Layne Claudie

- Walt Disney Quote - DIS | ADVFN

- Disney Stocks Soar as Analyst Claims “The Magic Is Back” | Disney Dining

A Brief History of The Walt Disney Company

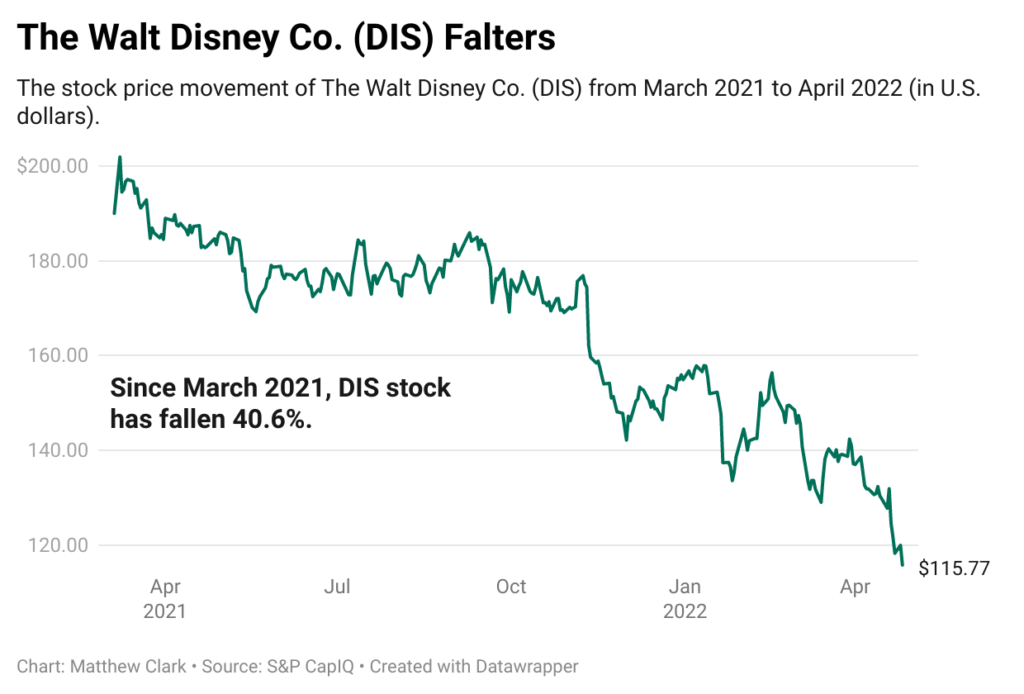

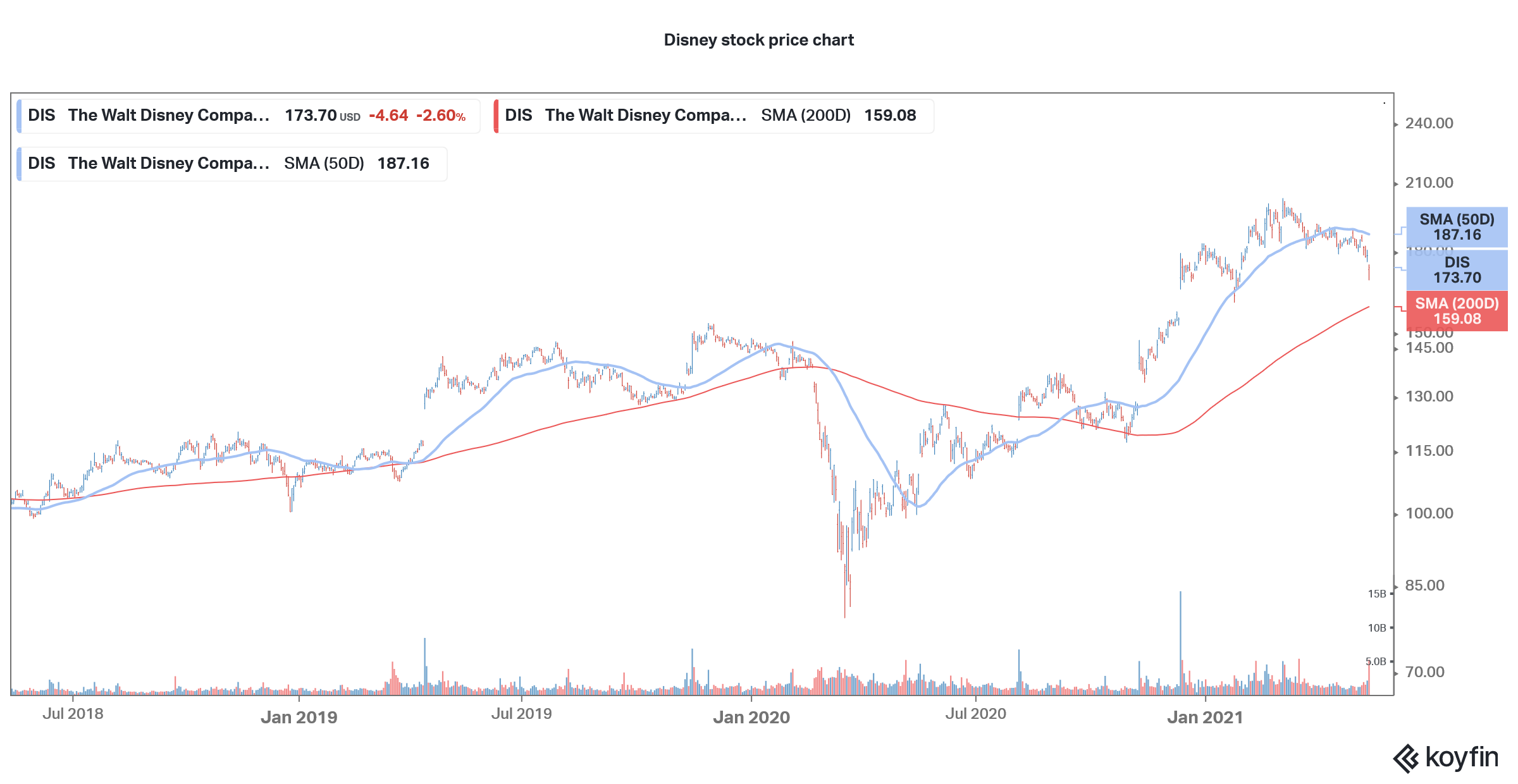

DIS Stock Price and Performance

Despite these challenges, Disney has continued to innovate and expand its offerings, including the launch of its highly successful streaming platform, Disney+. With a growing subscriber base and a vast library of content, Disney+ has become a significant contributor to the company's revenue and growth prospects.

Segments and Growth Drivers

The Walt Disney Company operates through four primary business segments: Media Networks: Including ESPN, ABC, and Disney Channel, this segment generates revenue through advertising, affiliate fees, and content licensing. Parks and Resorts: Comprising theme parks, resorts, and cruise lines, this segment drives revenue through ticket sales, merchandise, and hospitality services. Studio Entertainment: Encompassing film and television production, this segment generates revenue through box office sales, home entertainment, and content licensing. Consumer Products: Including licensing, publishing, and retail, this segment drives revenue through the sale of Disney-branded merchandise and intellectual property. These segments, combined with the company's strategic acquisitions and innovative initiatives, have positioned Disney for long-term growth and success.